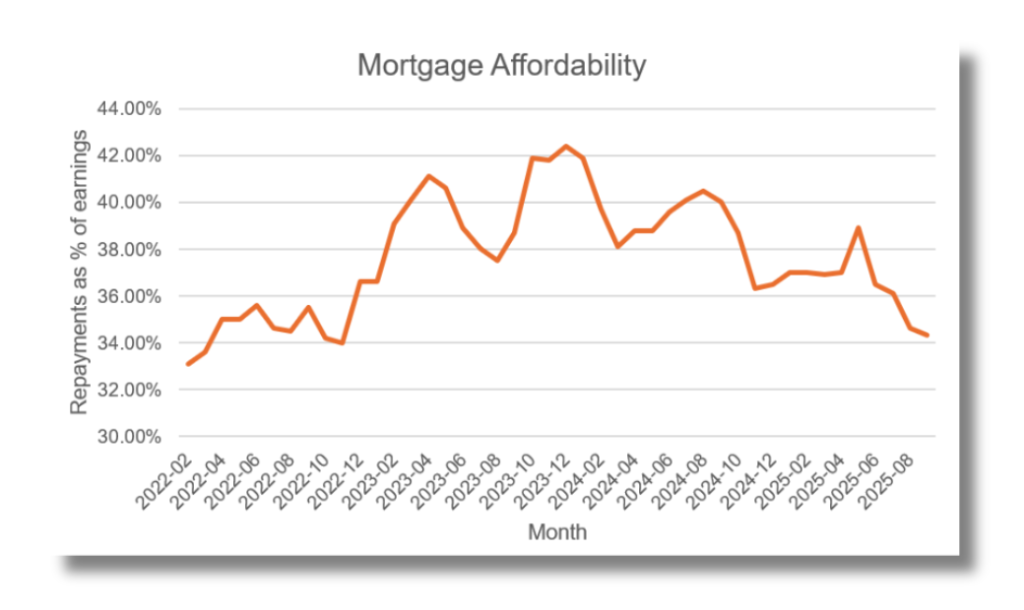

Our latest Mortgage Affordability Index shows the average borrower’s mortgage accounted for 34.3% of their salary in September – the lowest proportion since November 2022. This is down from 34.6% in August and 40% a year earlier, our research found.

Falling mortgage rates, which are down 57 basis points to an average of 4.19% over the past 12 months, typically saving the average borrower around £300 a year compared to 12 months ago, is the main driver behind the improvement in affordability.

However, rising wages, which rose 4.75% in the year to September, have also made mortgage finance more affordable to the average borrower over the past year.

The Mortgage Affordability Index combines official wage and mortgage rate statistics with our own loan data to determine the relative affordability of mortgage finance in proportion to the average borrower’s earnings.

Rob Clifford, Chief Executive at Stonebridge, commented:

“Mortgage affordability has improved significantly over the past year, reaching its most favourable level since late 2022. Falling mortgage rates, alongside rising wages, mean borrowers are spending a smaller share of their income on housing—a welcome relief for first-time buyers and those looking to move. Looking ahead, there is some expectation that the Bank of England cuts the base rate in December, however we first need to see what the government’s budget holds in store for us at the end of the month.

“While fixed-rate mortgages are priced off swaps rather than the base rate, a lower-rate environment could encourage lenders to bring more competitive deals to market. This suggests affordability could continue to improve into 2026, provided house prices don’t rise unexpectedly.”

Stonebridge’s Mortgage Affordability Index:

| Month | Mortgage repayments as % of salary |

|---|---|

| September 2024 | 40.1% |

| October 2024 | 38.7% |

| November 2024 | 36.3% |

| December 2024 | 36.5% |

| January 2025 | 37.0% |

| February 2025 | 37.0% |

| March 2025 | 36.9% |

| April 2025 | 37.0% |

| May 2025 | 38.9% |

| June 2025 | 36.5% |

| July 2025 | 36.1% |

| August 2025 | 34.6% |

| September 2025 | 34.3% |

| Long-running average | 36.9% |

Stonebridge is one of the largest independent networks in the UK that currently authorises and supervises more than 1,300 advisers across the UK.

Independent industry research has recently shown that more AR firms have chosen to join Stonebridge in 2025 than any other mortgage and protection network.

If you’re looking for a network to support you and your business with a market-leading level of support and technology, contact us here to discuss how our proposition can help.